The Advantages of ETFs

Flexibility and Liquidity

ETFs (Exchange Traded Funds) are bought and sold just like stock, and unlike

Mutual Funds, can be purchased at intraday prices, bought on margin, and even sold short.

Diversification

Investing in an ETF means buying into a basket of securities, thereby

diversifying your investment and reducing your risk.

No Cost

ETFs usually have lower expenses than other investments like mutual funds.

ETFs at Perception Capital HK are free.

Global Investing

There are ETFs that track markets in various regions or countries, making it

an ideal way to invest overseas.

Transparency

ETFs track individual indices or commodities and you can easily tell where

your asset is being invested.

Tax Efficiency

An ETFs tracks an index, making it less prone to turnover, resulting in lower

capital gains tax.

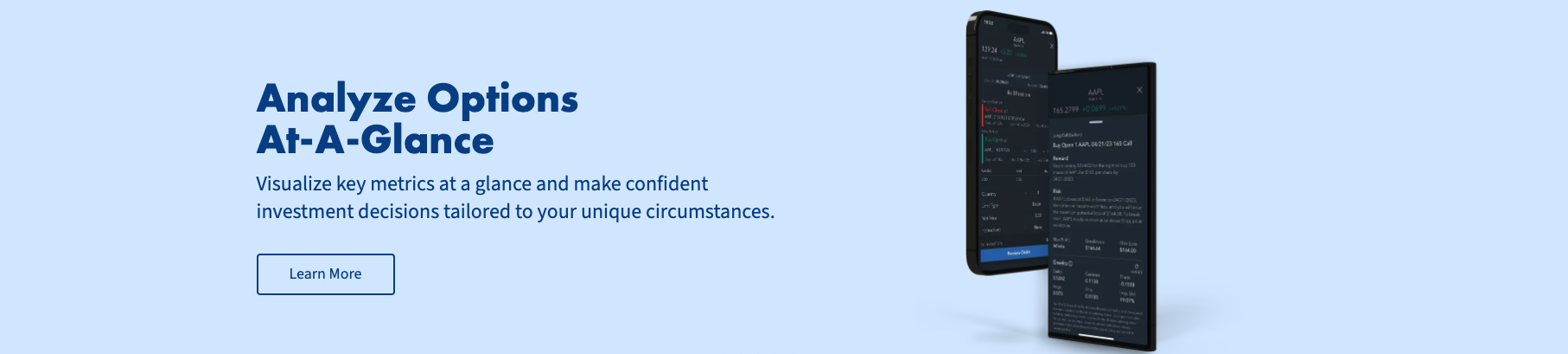

Why Trade ETFs with Perception Capital HK

More Choices, Opportunities to Save

Perception Capital HK lets you trade every ETF available in the market and offers more

commission-free ETF trading opportunities than any other broker.

Comprehensive Research & Tools

Use our easy-to-use screener and Morningstar research to help you find the

right ETFs based on performance and analyst ratings.

Help from Registered Representatives

Our customer service representatives are available to assist you via Chat,

phone, email.

Award-Winning Broker

*Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses.

Please read the prospectus carefully before investing. You can review a symbol’s prospectus by searching for a

detailed quote and clicking on the “prospectus” link.

Trading involves high risks. Perception Capital HK's offering in commission-free ETFs is not meant to encourage investors to

trade in high frequency without paying attention to the possible risks, such as international risk, currency

risk, commodity risk, leverage risk, credit risk, and interest rate risk. Additional risks may also include, but

are not limited to, investments in foreign securities, especially emerging markets, real estate investment

trusts (REITs), fixed income, small-capitalization securities, and commodities.

Investors should carefully consider the investment objectives, i.e., risks, charges and expenses of ETFs before

investing. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to

volatility through the use of leverage, short sales of securities, derivatives and other complex investment

strategies. These products are for sophisticated investors who understand their risks (including the effect of

daily compounding of leveraged investment results), and who intend to actively monitor and manage their

investments on a daily basis.

You can buy and sell ETFs available through the Perception Capital HK’s commission-free ETF program without paying brokerage

commissions. The commission-free trades on ALL eligible ETFs must be placed online in a Perception Capital HK account.

Commission-free trades apply to all buy and sell transactions. Other fees may apply for trade orders placed

through a customer service representative. Perception Capital HK reserves the right to update and change the terms and

conditions of the Free Commission ETFs at any time without prior notice.

Morningstar Risk-Adjusted Ratings: The Overall Rating is derived from a weighted average of the performance

figures associated with its 3-, 5-, and 10- year (if applicable) Morningstar Rating Metrics. Morningstar, Inc.

is an independent publisher of mutual fund research and ratings. Ratings reflect a fund's risk-adjusted 3-, 5-,

and 10-year total returns, including any sales charge. A Fund is rated against all other funds in its category.

5 stars are assigned to the top 10%; 4 stars to the next 22.5%; 3 stars to the next 35%; 2 stars to the next

22.5%; and 1 star to the bottom 10%. Morningstar only rates funds with at least a 3-year history.

Investment returns will fluctuate and are subject to market volatility, so that an investor’s shares, when

redeemed or sold, may be worth more or less than their original cost. ETFs are subject to management fees and

other expenses. Unlike mutual funds, shares of ETFs are not individually redeemable directly with the ETF.

Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV).

Investment information provided by Perception Capital HK is for educational purposes only and should not be considered as an

individualized recommendation or personalized investment advice. The investment strategies mentioned here may

not be suitable for everyone. You are fully responsible for your investment decisions.

Research and planning tools are obtained by unaffiliated third party sources deemed reliable by Perception Capital HK. However,

Perception Capital HK does not guarantee accuracy and completeness, and makes no warranties with respect to results to be

obtained from their use.

Market volatility, volume and system availability may delay account access and trade executions.

This is not an offer or solicitation in any jurisdiction where Perception Capital HK is not authorized to conduct securities

transaction.